I Didnt Sign Up for Medical in Time Can I Get It Again

If you don't enroll in a health insurance plan by the end of open enrollment, your options are normally very limited. | Image: Pixel-Shot / stock.adobe.com

Q. If I don't enroll in a health insurance plan by the end of open enrollment (January 15 in most states), what options do I have?

A. In general, your options for coverage are very limited if you didn't enroll in a plan by the end of open enrollment. In most states, open enrollment for 2022 coverage ended on January 15, 2022, although Idaho's open enrollment period ended in December and some states have extended enrollment into the latter half of January. The open enrollment period applies outside of the exchange as well.

But there may be exceptions that will allow you to enroll outside of open enrollment:

Medicaid/CHIP

Medicaid/CHIP enrollment is available year-round for those who qualify. If your income drops to a Medicaid-eligible level later in the year, you'll be able to enroll at that point. Similarly, if you're on Medicaid and your income increases to a level that makes you ineligible for Medicaid, you'll have an opportunity to switch to a private plan at that point if you wish to do so.

However, during the COVID pandemic emergency period, states cannot drop people from their Medicaid rolls unless they move out of state or request that their coverage be terminated. So an increase in income will not trigger a Medicaid termination until after the pandemic emergency period is over.

State-run programs with year-round enrollment

There are also some states where other types of coverage can be obtained outside of open enrollment:

- Basic Health Programs in New York and Minnesota.

- The ConnectorCare program in Massachusetts (for people who are newly eligible or who haven't enrolled before).

The new Covered Connecticut program became available in mid-2021, and enrollment was open from that point through mid-January 2022 for anyone eligible. It appears that future enrollment will follow normal rules, with applicants able to sign up during open enrollment or a special enrollment period, just like regular health plans in the marketplace/exchange.

Native Americans

Native Americans can enroll in plans through the exchange year-round. Here's more about special provisions in the ACA that apply to Native Americans.

Special enrollment period

If you have a qualifying event during the year, you'll have access to a special enrollment period. Qualifying events include things like marriage (assuming at least one spouse already had coverage prior to the marriage), the birth or adoption of a child, loss of other minimum essential coverage, or a permanent move to a new geographical area where the available health plans are different from what was available in your prior location (assuming you already had coverage prior to your move).

Our guide to special enrollment periods in the individual health insurance market explains all of the qualifying events and the rules that apply to each one.

(If you're uncertain about your eligibility for a special enrollment period, call (800) 436-1566 to discuss your situation with a licensed insurance professional.)

In 2017, HHS implemented a variety of changes aimed at market stabilization, particularly for the individual market. HealthCare.gov now requires all applicants to provide proof of their qualifying events before being allowed to finalize enrollments outside of open enrollment. The state-run exchanges can use their own discretion on this, but do tend to require proof of all qualifying events (HHS proposed a rule change that would require all exchanges to verify qualifying events for at least 75% of all special enrollment period applicants who are new to the exchange, but the Biden administration did not finalize that rule change). In general, if you're enrolling mid-year, be prepared to provide proof of the qualifying event that triggered your special enrollment period.

If you do not have a qualifying event, there is no way to enroll in an ACA-qualified individual health insurance policy outside of normal open enrollment, either on or off-exchange. This is very different from the pre-2014 individual health insurance market, where people could apply for coverage at any time. But of course, approval used to be contingent on health status, which is no longer the case.

Other plans – and their limits

Unless you have a qualifying event or become eligible for Medicaid or employer-sponsored coverage, the only plans you can purchase outside of open enrollment are those that are not deemed minimum essential coverage.

Unless you have a qualifying event or become eligible for Medicaid or employer-sponsored coverage, the only plans you can purchase outside of open enrollment are those that are not deemed minimum essential coverage.

This includes discount plans, critical illness coverage, dental and vision plans, accident supplements, Farm Bureau plans available in several states, and short-term medical insurance policies. Of the plans that are available outside of open enrollment, short-term policies are probably the best coverage option, but they should not be considered a good substitute for an ACA-qualified plan.

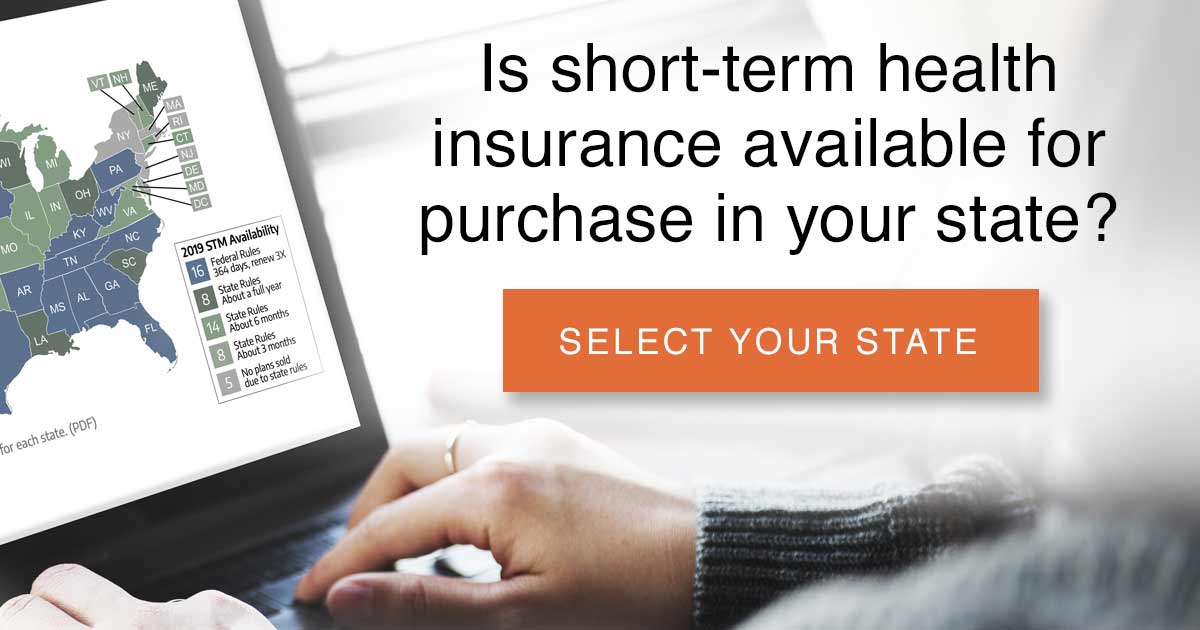

Although ACA-qualified policies are all guaranteed-issue during open enrollment and special enrollment periods, short-term policies are not regulated by the ACA. They continue to be medically underwritten and provide no coverage for pre-existing conditions. Under federal rules that took effect in late 2018, short-term health insurance plans can have initial terms of up to 364 days, and total duration, including renewals, of up to three years.

But more than half of the states have stricter limits for short-term health plans, either banning them altogether or limiting them to shorter durations. And there are more comprehensive short-term plans available in some areas. For example, Idaho rolled out a new type of short-term health plan in 2020, with much more robust coverage than traditional short-term plans. And Iowa requires all short-term plans to meet certain coverage requirements (but the plans are still much less robust than ACA-compliant plans). In the states that defer to the federal rules, some insurers offer 364-day terms and guaranteed renewability, while others choose to only offer shorter terms and/or non-renewable plans.

So if you missed open enrollment and are hoping to enroll in a short-term health insurance plan as a substitute for real individual major medical coverage, the availability of this option will very much depend on where you live and how healthy you are. Short-term medical plans are not ideal, but they are a much better option than remaining uninsured.

It's important to understand that short-term plans are, by definition, temporary health insurance policies, and they have set expiration dates. And while the loss of other health insurance that is considered minimum essential coverage is a qualifying event that triggers a special open enrollment period for ACA-compliant individual market plans, short-term policies are not minimum essential coverage. So you will not be able to purchase an ACA-compliant plan outside of open enrollment when your short-term policy expires (you would, however, be able to join your employer's plan when your short-term plan ends, as the termination of a short-term plan is a qualifying event for employer-sponsored coverage; HHS clarified that point in the new rules for short-term plans).

Discount plans and supplemental policies tend to be guaranteed issue, but their coverage is gossamer thin and provides no cap on out-of-pocket exposure.

Meager coverage

The plans available outside of open enrollment (without a qualifying event) will provide meager coverage compared with the ACA-qualified plans that are sold on and off-exchange. And purchasing them will not satisfy the individual mandate in states that still impose a penalty for not having health insurance coverage (New Jersey, Massachusetts, California, Rhode Island, and the District of Columbia; short-term plans aren't available in most of those areas, but other types of non-ACA-compliant coverage, such as fixed indemnity plans, tend to be available. They will not, however, fulfill the state-based individual mandates).

Louise Norris is an individual health insurance broker who has been writing about health insurance and health reform since 2006. She has written dozens of opinions and educational pieces about the Affordable Care Act for healthinsurance.org. Her state health exchange updates are regularly cited by media who cover health reform and by other health insurance experts.

Source: https://www.healthinsurance.org/faqs/if-i-dont-enroll-in-a-new-plan-by-the-open-enrollment-deadline-what-are-my-options-after-that/

0 Response to "I Didnt Sign Up for Medical in Time Can I Get It Again"

Post a Comment